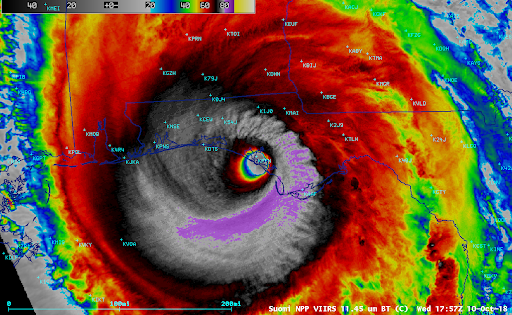

Hurricane Michael: One Year Later

Hurricane Michael struck the Florida Panhandle on October 10, 2019 causing 16 U.S. direct fatalities and causing an estimated 25.1 billion dollars in damages (1). After being initially listed as a Category 4 hurricane, the National Hurricane Center increased Hurricane Michael to Category 5 with estimated wind speeds of 160 mph (2). Michael is the first hurricane to make landfall in the United States as a Category 5 since Hurricane Andrew in 1992, and only the fourth on record.

According to the Florida Office of Insurance Regulation, insurance companies were required to begin submitting data on Hurricane Michael claims on October 12, 2018. As of October 11, 2019, over 20,000 claims remain open which include 14,891 open residential claims and 4,154 commercial claims (3). According to the Florida Office of Insurance Regulation, insurers have reported $6,906,918,311 in “losses”.

The Data

The below table shows the breakdown of the claims information to date.

What is interesting is the Florida Office of Insurance Regulation is only currently scheduled to continue to collect data on Hurricane Michael claims through October 25, 2019. With so many open claims, wouldn’t it be prudent for the Florida Office of Insurance Regulation to continue to monitor the administration of Hurricane Michael Claims? Florida’s new Insurance Consumer Advocate, Tasha Carter, called the number of open claims, “concerning”.

In comparison, Hurricane Irma affected far more properties but did less damage on average than Hurricane Michael, yet nine months after Hurricane Irma made landfall, only 9 percent of claims were still open compared to close to 14 percent of Hurricane Michael claims.

| Lines of Business | Number of Claims | Closed Claims (paid) | Closed Claims (not paid) | Number Claims Open | Percent Claims Closed |

| Residential Property | 98,321 | 70,104 | 13,326 | 14,891 | 84.9% |

| Homeowners | 72,228 | 50,137 | 10,127 | 11,964 | 83.4% |

| Dwelling | 15,825 | 11,287 | 2,397 | 2,141 | 86.5% |

| Mobile Homeowners | 9,374 | 8,178 | 649 | 547 | 94.2% |

| Commercial Residential | 894 | 502 | 153 | 239 | 73.3% |

| Commercial Property | 11,061 | 4,482 | 2,425 | 4,154 | 62.4% |

| Private Flood | 233 | 159 | 49 | 25 | 89.3% |

| Business Interruption | 954 | 359 | 241 | 354 | 62.9% |

| Other Lines of Business* | 37,778 | 32,526 | 4,192 | 1,060 | 97.2% |

| TOTALS | 148,347 | 107,630 | 20,233 | 20,484 | 86.2% |

Total Estimated Insured Losses: $6,906,918,311

| County | Number of Claims | Closed Claims (paid) | Closed Claims (not paid) | Number Claims Open | Percent Claims Closed |

| BAY | 88,830 | 64,743 | 8,948 | 15,139 | 83.0% |

| CALHOUN | 4,078 | 3,410 | 290 | 378 | 90.7% |

| FRANKLIN | 2,329 | 1,267 | 863 | 199 | 91.5% |

| GADSDEN | 6,230 | 4,571 | 1,111 | 548 | 91.2% |

| GULF | 8,248 | 5,893 | 1,245 | 1,110 | 86.5% |

| HOLMES | 1,028 | 741 | 225 | 62 | 94.0% |

| JACKSON | 14,010 | 11,444 | 1,186 | 1,380 | 90.1% |

| JEFFERSON | 192 | 135 | 53 | 4 | 97.9% |

| LEON | 10,192 | 6,810 | 2,953 | 429 | 95.8% |

| LIBERTY | 1,181 | 993 | 119 | 69 | 94.2% |

| MADISON | 53 | 38 | 12 | 3 | 94.3% |

| SUWANNEE | 24 | 14 | 9 | 1 | 95.8% |

| TAYLOR | 62 | 40 | 19 | 3 | 95.2% |

| WAKULLA | 1,430 | 964 | 416 | 50 | 96.5% |

| WASHINGTON | 3,568 | 2,825 | 468 | 275 | 92.3% |

| REST OF THE STATE | 6,892 | 3,742 | 2,316 | 834 | 87.9% |

| TOTAL | 148,347 | 107,630 | 20,233 | 20,484 | 86.2% |

It is important to note when reviewing the above table, the number of “Closed Claims (paid)” can refer to when an insurance company provides an estimate to its insured and immediately thereafter lists the claim as closed even though the Insured may not have even begun to restore the property due to availability of materials and contractors to do the work. Typically, once an insurance company makes and initial payment the claim is officially “closed” in the insurance company’s system.

It is also important to note, that while over 98 thousand residential claims have been made, insurance companies have closed over 13 thousand claims without making payment. The question the State of Florida should also be asking is why over 13 thousand claims were closed without making payment?

According to Florida Statute 627.70131, Insurers have “90 days after an insurer receives notice of an initial, reopened, or supplemental property insurance claim from a policyholder, the insurer shall pay or deny such claim or a portion of the claim unless the failure to pay is caused by factors beyond the control of the insurer which reasonably prevent such payment.” This law allows insurance companies months to provide their insured with an estimate. Then if a dispute between the Insurance Company and their insured arises, this deadline could be extended.

The devastation in the Panhandle region continues. The photograph above is of the city of Lynn Haven taken 8 months after Hurricane Michael which shows communities along the panhandle are still littered with downed trees, tarped roofs, and piles of debris.

Per Florida Statute 627.70132, titled “Notice of Windstorm or Hurricane Claim”:

A claim, supplemental claim, or reopened claim under an insurance policy that provides property insurance, as defined in s. 624.604, for loss or damage caused by the peril of windstorm or hurricane is barred unless notice of the claim, supplemental claim, or reopened claim was given to the insurer in accordance with the terms of the policy within 3 years after the hurricane first made landfall or the windstorm caused the covered damage. For purposes of this section, the term “supplemental claim” or “reopened claim” means any additional claim for recovery from the insurer for losses from the same hurricane or windstorm which the insurer has previously adjusted pursuant to the initial claim. This section does not affect any applicable limitation on civil actions provided in s. 95.11 for claims, supplemental claims, or reopened claims timely filed under this section.

What Does This Mean For Victims of Hurricane Michael?

It means Hurricane Michael victims in the State of Florida have less than two (2) years in order to make an initial claim or to re-open there “paid” and closed claim or dispute their claim which was denied. It is also important to note that Hurricane Irma victims have less than one (1) year in which to re-open or make an initial claim.

If you have any questions about your claim, or about the process in general, we strongly urge you to speak with a qualified, conscientious law firm that can guide you through this perilous process. Cohen Law Group has a team of attorneys prepared to assist you in any way. Should you have any questions, please do not hesitate to contact us at 877-440-4878 for a free consultation.

COHEN LAW GROUP

REFERENCES:

(1) “Assessing the U.S. Climate in 2018”. National Centers for Environmental Information (NCEI). February 6, 2019. Retrieved February 9,2019.

(2) https://www.noaa.gov/media-release/hurricane-michael-upgraded-to-category-5-at-time-of-us-landfall

(3) https://www.floir.com/Office/HurricaneSeason/HurricaneMichaelClaimsData.aspx

DISCLAIMER: This website is for informational purposes only and does not provide legal advice. Please do not act or refrain from acting based on anything you read on this site. Using this site or communicating with Cohen Law Group through this site does not form an attorney/client relationship. This site is legal advertising. Please review the full disclaimer for more information by clicking here.